|

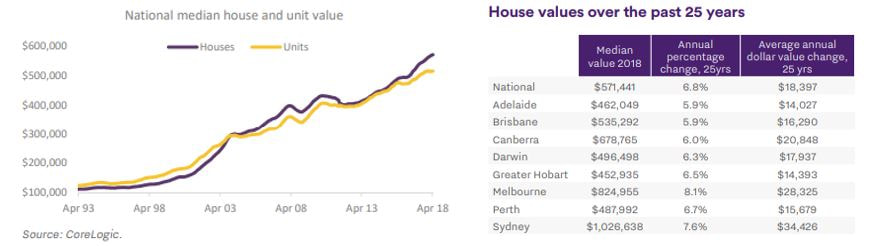

Making money in a falling property market? Unless someone lived in a cave for the last 10 months, everyone is aware that the property market in eastern Australia has hit its peak and the prices are now correcting itself. Some property investors are perplexed now, as the same media outlets that was cheering the price growth and writing about first home buyer difficulties, are now writing on price reductions and first home buyer opportunities! As with any investment asset class property prices go through cycles, and the significant price growth that we experienced in NSW and VIC from 2013 to 2018, is now letting off steam and poised for a correction that we need to have. As a buyers agency we have stayed away from investing in 'Greater Sydney' areas for last 2 years due to the potential risk of market tanking. Property investments need to be done with a long term view, as there are significant transaction costs involved in either a purchase or a sale. Knee jerk reactions and panic selling by property owners in response to for ever changing market conditions, is a recipe for disaster. For young investors who have not previously experienced a full property cycle, let's take the performance of property in the last 25 years. (I would expect a similar review on other assets like ASX shares will yield a comparable result) Over the last 25 years the national median house value has risen 412% or $459,900 as per the below graph. Source - Aussie and CoreLogic 25 years of housing trends. As evident in the chart on the left there have been times where the market has dipped or moved sideways for a period time. Which is the reason why taking a long term view on property performance, adhering to a proven investment strategy and building financial buffers for hard times is crucial.

What are the options available to make money in a market going down or sideways? As buyers agents we buy properties with the ability to add value and manufacture growth. This period could be a time to do the renovation and add value, build an addition, build a secondary dwelling or lodge that DA for a subdivision. Savvy investors will also keep an eye for properties sold off in the market at a discount, by the panic sellers. It's not all doom and gloom in every property location at the moment, as there are few locations out there that providing significant upside for property investors. The market downturns can be scary and difficult, but following a proven strategy you can come out from the other side unharmed. If you are a new investor or an existing investor keen to rebalance the portfolio, give us call on 02 9994 8003.

5 Comments

|

CategoriesArchives

November 2018

|

RSS Feed

RSS Feed