|

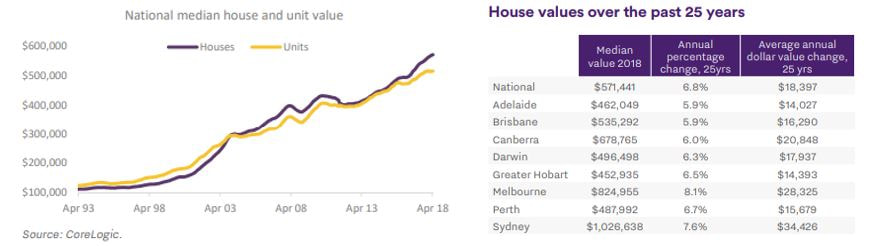

Making money in a falling property market? Unless someone lived in a cave for the last 10 months, everyone is aware that the property market in eastern Australia has hit its peak and the prices are now correcting itself. Some property investors are perplexed now, as the same media outlets that was cheering the price growth and writing about first home buyer difficulties, are now writing on price reductions and first home buyer opportunities! As with any investment asset class property prices go through cycles, and the significant price growth that we experienced in NSW and VIC from 2013 to 2018, is now letting off steam and poised for a correction that we need to have. As a buyers agency we have stayed away from investing in 'Greater Sydney' areas for last 2 years due to the potential risk of market tanking. Property investments need to be done with a long term view, as there are significant transaction costs involved in either a purchase or a sale. Knee jerk reactions and panic selling by property owners in response to for ever changing market conditions, is a recipe for disaster. For young investors who have not previously experienced a full property cycle, let's take the performance of property in the last 25 years. (I would expect a similar review on other assets like ASX shares will yield a comparable result) Over the last 25 years the national median house value has risen 412% or $459,900 as per the below graph. Source - Aussie and CoreLogic 25 years of housing trends. As evident in the chart on the left there have been times where the market has dipped or moved sideways for a period time. Which is the reason why taking a long term view on property performance, adhering to a proven investment strategy and building financial buffers for hard times is crucial.

What are the options available to make money in a market going down or sideways? As buyers agents we buy properties with the ability to add value and manufacture growth. This period could be a time to do the renovation and add value, build an addition, build a secondary dwelling or lodge that DA for a subdivision. Savvy investors will also keep an eye for properties sold off in the market at a discount, by the panic sellers. It's not all doom and gloom in every property location at the moment, as there are few locations out there that providing significant upside for property investors. The market downturns can be scary and difficult, but following a proven strategy you can come out from the other side unharmed. If you are a new investor or an existing investor keen to rebalance the portfolio, give us call on 02 9994 8003.

5 Comments

Sydney’s property market is only “just keeping its head above water” with almost half of homes failing to sell under the hammer. This compares to 78 per cent of homes selling on the same weekend last year.

For example In August 2016, 11.6 per cent of homes were withdrawn but by November last year that figure rose to 33 per cent. Although the numbers have improved, almost one in four sellers in February, decided not to go ahead with their auction as planned. SQM research Louis Christopher said the downturn was a result of a regulatory double-whammy when APRA cracked down in interest only home loans and the federal government clamped down on tax deductions and depreciation on investor property related expenses and items. Read more at: https://www.domain.com.au/news/sydneys-property-market-just-keeping-head-above-water-as-almost-half-of-homes-fail-to-sell-at-auction-20180317-h0xilm/ More and more NSW off the plan developments are in the news, with buyers made to make additional payments to secure the property, when developers rescind the contract under a 'sunset clause'. Sunset clause allows for either the buyer or the developer to pull out of the contract, if the completion date is not met within a given time period.

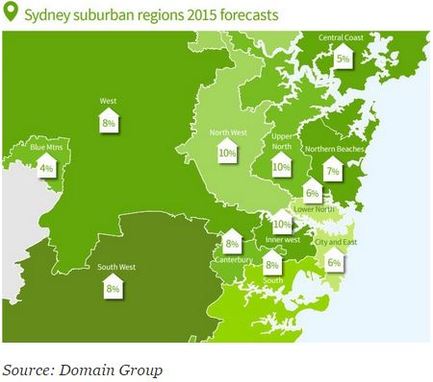

There are reports that once rescinded, same properties get advertised back on the market at a higher price to increase the profit margin of the developer. This can leave the buyers at a disadvantage at times when property prices go up, as their deposit money get tied up for a long period, and they will be required to come up with a higher deposit than previous time to secure a similar property. Buying off the plan is a risky and speculative investment strategy and if you plan to buy property off the plan, make sure that you consult a property lawyer, as off the plan contracts can greatly favour the developer. Australian Property Selectors do not buy off the plan properties, but use more effective and safe strategies like buying existing cheaper properties that are located close proximity to new developments. Good read below from CM Lawyers on - what should be checked before buying off the plan property? http://www.news.com.au/finance/real-estate/why-you-should-always-read-the-fine-print-developers-demand-1m-from-first-home-buyers/story-fndban6l-1227233970770  Domain group Senior economist Dr Andrew Wilson, predicts solid growth for Sydney in 2015 as well fuelled by low interest rates, increased investor activity and high level of immigration. In 2013 Sydney prices recorded a growth of 15.4%, and in 2014 an increase of 14%. Wilson forecast the following growth rates for Sydney regions in 2015;

The 2015 auction clearance rates were at record levels in late summer and this is expected to continue into autumn as well, with boom-time conditions continuing without a slowdown. At Australian Property Selectors, we caution the investors blindly following the market and emphasize the need to select investment properties for the right reasons. The rents in Sydney have not kept up to the pace with the capital growth in last two years, resulting in low rental yields. Therefore some of the properties sold now will end up draining cash on a monthly basis, from the investors. We are bullish on pockets of Sydney which are having massive infrastructure developments and employment creation, which will do well in terms of both rent and capital growth. Contact us today, for an obligation free consultation to understand how Australian Property Selectors can enable you to achieve your property investment goals. Read the full article at http://goo.gl/8tiLDi $1.5 million to get a Sydney 3 bed house or a French castle in Bordeaux, is an interesting comparison.

|

CategoriesArchives

November 2018

|

RSS Feed

RSS Feed